2021 NL Taxation workshop 2021荷兰connect now 培训

一个被明媚的春光打开的周六上午,我们如期在线与80多位学员见面了。

本期的主题主要是大家关注的2021年荷兰个人税务讲座,

整个会晤组与讲师在过去的一个月中为大家把个人报税的知识做了框架的梳理与内容的更新。

主持人宣布了讲座记录后,connect now俱乐部的负责人Gaby Zeng 表达了本次培训与俱乐部的定位与初心,为的是帮助更多的外籍居民增加在荷兰经商,工作,生活的重要知识赋能,形成一个积极互助的圈子。

随后我们的特邀讲师Vincent 为大家带来了近3个小时知识分享。

Vincent 马斯特里赫特大学的税法学位(专注于国际税法)和莱顿大学的欧洲法律硕士学位;

在荷兰税务领域拥有超过10年的工作经验;

荷兰税务机关De Belastingdienst;

毕马威担任外籍税务顾问;

在鹿特丹伊拉斯谟大学(Erasmus University Rotterdam)担任(国际)税法讲师

合作出品了一本包含国际税务条约的精选文本的书

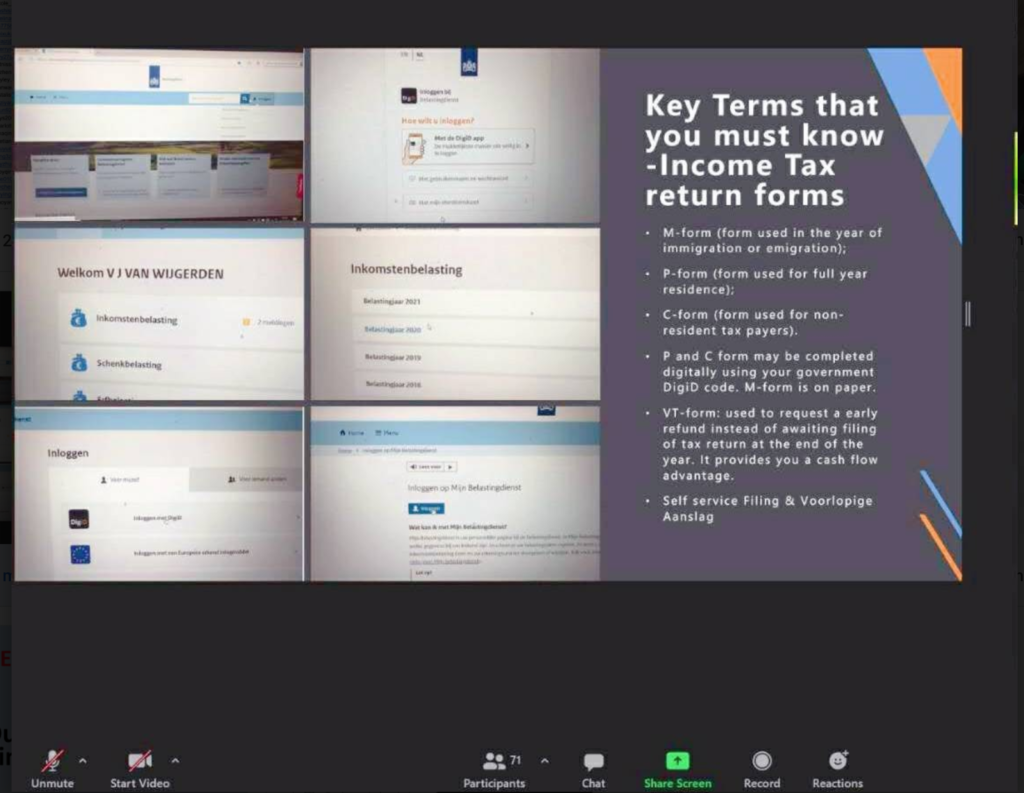

本次分享的内容从整体到版块,为大家分别介绍了:

荷兰税务构成

荷兰税务的关键术语

个人税务优惠政策与申报技巧

自住房与投资房的税收

box 1-box 3 的定义,核算

30%ruiling 的详细讲解

为了让部分学员的需求得到解答,整个培训中配合了对关键部分的中文提要讲解,会议在大家积极的问题中,讲师也特别延时,解答了大家的问题。

为了便于大家再次复习,会后学员们可以通过:

讲稿,网课视频继续学习外,还收到了讲师对2个重要版块:报税流程视频与新政对个人报税的应对措施的4大材料外。

会晤中还请到讲师对80多个问题进行了大致的梳理与提要。

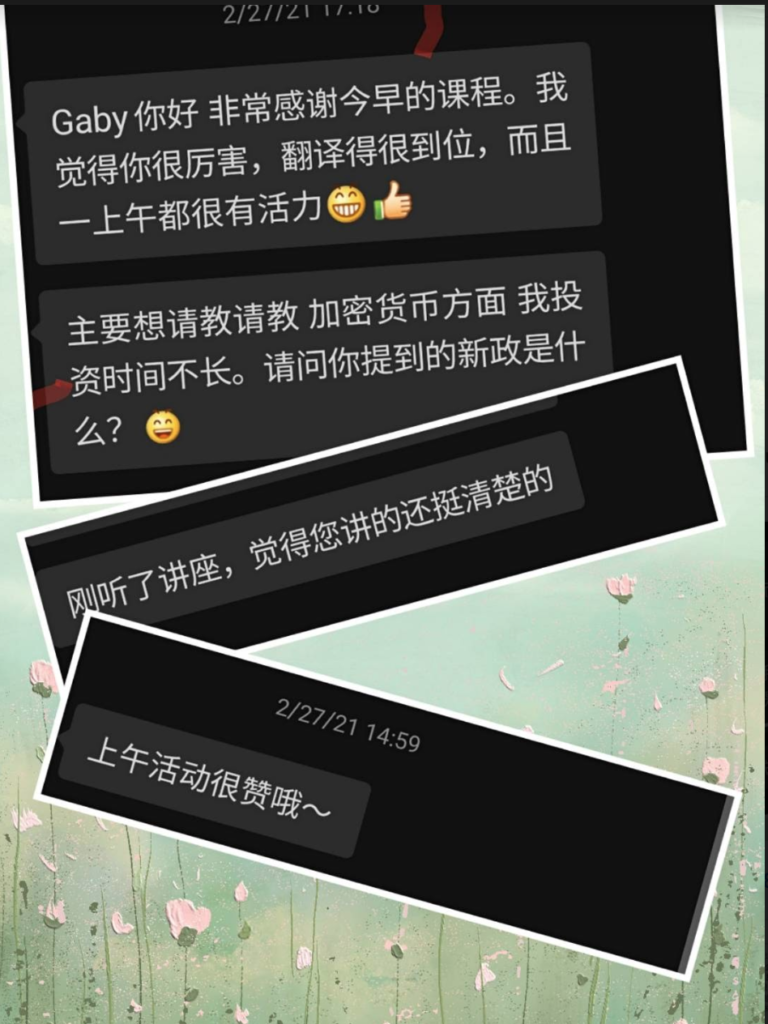

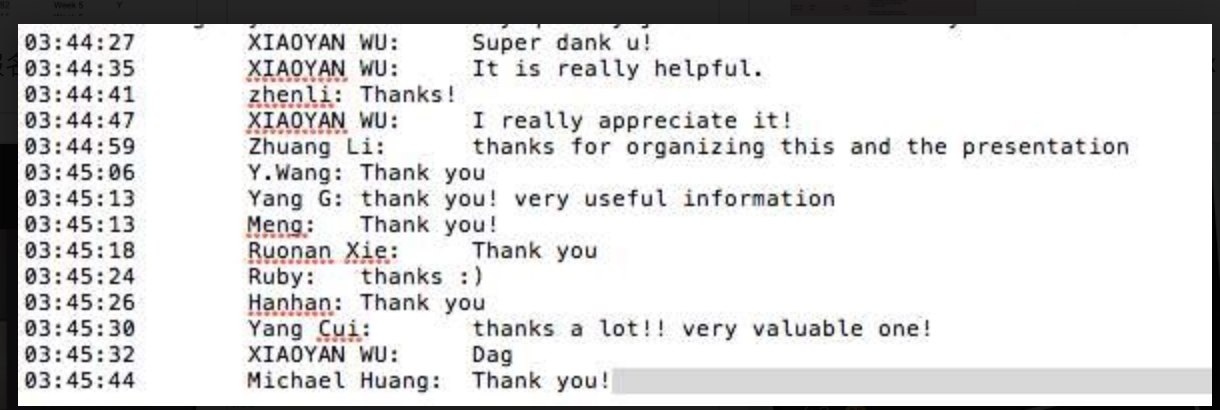

会后我们收到了很多学员的好评与优化建议。

更多税务咨询欢迎与我们取得联系。

This Saturday morning is opened by a bright sunshine of spring, we met more than 80 students online as scheduled.

The main theme of this workshop is the 2021 personal tax lecture in the Netherlands,

The entire event group and the lecturer have been developing the content over the past 90 days..

After the host announced, Gaby Zeng, head of the connect Now club, expressed the positioning and initial of the training and the club, in order to help more foreign expats to increase the important knowledge of doing business, working and living in the Netherlands,

Then our guest lecturer Vincent brought us nearly 3 hours of knowledge workshop, about our speaker:

A degree in Tax Law (with focus on International Tax Law) from the University of Maastricht and a Masters degree in European Law from Leiden University.

He has over 10 years of work experience in the field of taxation.

worked for the de Belastingdienst (Dutch Tax Authorities).

worked for KPMG Meijburg as expatriate tax consultant.

co-authored a book containing selected texts of international tax treaties for expatriate tax consultants.

The content of this share from the whole to the section, for everyone to introduce:

Dutch tax composition

Key terms for Dutch tax

Personal tax incentives and reporting skills

Tax on self-housing and investment housing

definition of box 1-box 3, accounting

Detailed explanation of 30% ruling

In order to get some of the students ‘ needs to be answered, the whole training with the key part of the Chinese summary to explain, the meeting in everyone’s positive questions, the lecturer is also particularly delayed, to answer everyone’s questions.

In order to facilitate everyone to review again, after the meeting, the students can pass:

In addition to the speech, the online class video continued to learn, also received the lecturer on 2 important sections: tax filing process video and the new deal on personal tax filing response measures in addition to the 4 major materials.

During the meeting, the lecturers were also invited to sort out and outline more than 80 issues.

After the meeting, we received a lot of students ‘ praise and suggestions.